During the Democratic Presidential Primary, one of the major divides between the left and the center left was about how and how much to raise taxes on the wealthy. While every candidate cited income and wealth inequality as a major obstacle to an equitable society, the candidates differed philosophically on one important point: what the point of addressing income and wealth inequality should be.

Center-left politicians don’t view the massive concentration of wealth as a problem. Their concern is with raising the living conditions of those at the bottom. This school of thought suggests that it doesn’t matter if Jeff Bezos has $1 billion, $100 billion, or $10 trillion. The only real problem with inequality is that some people don’t have enough to eat or get a decent education or access adequate healthcare.

The politicians of the left, in contrast, think inequality is bad in and of itself. Even if we ensured that everyone had access to food and shelter and education and healthcare, society would still be deeply flawed if hundred-billionaires are allowed to exist. For a while during the campaign, the slogan “every billionaire is a policy failure” became popular in lefty social media circles.

The challenge posed by the contemporary tax code is that tax only applies to various forms of new money. The government taxes traditional income, it taxes gains from sales of assets (capital gains), it taxes some things (like Roth IRAs) on a deferred basis, and it taxes wealthy estates as they transfer ownership. None of these things reigns in the wealth of billionaires. At best, they marginally reduce the rate of growth of billionaires’ assets. So if your policy goals are to reduce inequality (rather than just bettering the living conditions of the worst off), you need to do something other than tax income and realized capital gains.

ProPublica’s Exposé

As it turns out, the picture of taxation on the wealthy is far less equitable than one might imagine. This week, ProPublica published the first story (of what’s expected to be several) detailing the actual effective tax rates paid by America’s wealthiest citizens. They pay remarkably little, sometimes even nothing at all. In the last decade, billionaires Warren Buffet, Jeff Bezos, Carl Icahn, Michael Bloomberg, and Elon Musk all paid $0 of income taxes at least once.

It’s important to understand that, unlike most Americans, the finances of the country’s wealthiest citizens—and correspondingly their taxes as well—are unusual. This isn’t like your upper-middle-class four-person family with $150,000 of wages and a little bit of interest/dividend income. Instead, the wealthy have raced far ahead of (and continue to accelerate away from) everyone else by virtue of the growth in value of their assets.

ProPublica actually calculated this by using the not-too-reliable-but-probably-directionally-correct annual estimates of wealth from Forbes. Using the Forbes estimates, ProPublica calculated that the wealthiest 25 Americans saw their wealth increase $401 billion from 2014-2018. No one gets paid billions of dollars. The wealthiest Americans own things (like stock or property) that have become significantly more valuable. They aren’t taxed on these increases in wealth unless they sell the assets, and even then, they are taxed at a lower rate than income.

The highest capital gains tax rate (on income more than $440K), is only 20%. A single tax filer begins paying a 22% income tax rate at around $40K of income. So a multibillionaire who sells stock that has appreciated in value since purchased pays 20% in taxes on those gains. If you work a good-paying job earning $100K per year, you will pay a marginal tax rate of 24% (though the cumulative federal income tax rate is 15%). But you will also have to pay FICA taxes (7.65%) and state and local taxes. Even without state and local taxes, however, your effective tax rate is over 20% (15% + 7.65%), so you’re paying a higher effective tax rate than the billionaire[1].

What the ProPublica story makes clear by providing individual examples is that the because of the nature of how the wealthy make money, they pay lower taxes than most other people. There are also additional tax breaks (like writing off financial losses), that, again, are available to the wealthy in ways they aren’t to everybody else.

Conceptually, people who understand tax policy have known that this disparity is theoretically possible, but the ProPublica article documents it to an extent that few would have thought possible. ProPublica shows us the growth in wealth of the US’s richest people side-by-side with what they paid in taxes. They are thus able to calculate a more precise measure of how little the wealthy are paying relative to their financial might.

The table below shows, for four billionaires, how much their wealth grew 2014-2018, how much income they reported in that period of time, how much they paid in taxes, and then what their true tax rate was.

So Jeff Bezos’s wealth grew by $99 billion dollars over these four years, but he paid less than $1 billion in taxes. Let’s say you have $200,000 in the bank, and you earn $100,000 this year. Your $200,000 gets a 5% annual rate of return in unrealized capital gains, so it goes up $10,000, which is your “wealth growth”, per this table. And you also would have paid $20-25 thousand dollars in taxes. So if we add your wealth growth and your income, we get $110,000. So we can quite easily see that $20,000 divided by $110,000 is way higher than the 0-3% effective tax rate these billionaires are paying. You would have to pay roughly $3,000 in taxes to have an equivalently low rate.

Elizabeth Warren’s 2-Cent Wealth Tax

The politicians in the left part of the Democratic Party understand the nature of this problem. One of Elizabeth Warren’s signature policy proposals is a 2-cent tax on wealth over $50 million. It now also includes a 6% wealth tax on wealth above $1 billion.

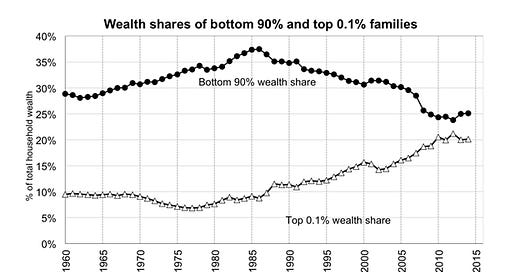

You can read the full proposal here, but I’d call your attention to the way Senator Warren identifies the problem. Her policy page includes one chart, the one above, which shows that for the last 40 years, the share of US wealth held by the top .1% has risen steadily. Meanwhile, the share of wealth held by the bottom 90% has declined.

To return to the philosophical debate, there are two reasons why massive amounts of accumulated wealth among the affluent are worth taxing. The first is that the country needs revenue to pay for expansions to the social safety net. Universal pre-K? Tax the wealthy. Enhanced federal funding for public transportation? Tax the wealthy. Medicare for all (or some watered-down equivalent)? Tax the wealthy.

The second is that, while it may not be objectively bad for one person to have a lot of money, money corresponds with power, and it is bad for individuals to have that much power. The connections between wealth and power are well-established, but one aspect that gets less attention is the way billionaires leverage their wealth for power even when giving it away.

Anand Giridharadas, author of the book Winners Take All about the very problem of billionaires, has written a helpful opinion piece in the New York Times about the dangers of even the “good” kind of billionaires. One useful point he makes here is about the immense power Bill Gates has over public health decisions. Why should one unelected person get to weigh in on vaccine policy because… he made a lot of money selling computer software?

Even if you don’t believe in limiting the growth of wealth for the wealthiest, and even if you don’t think we ought to spend a lot of money on expanding government social safety net programs or infrastructure, don’t you want to live in a society where one person can’t buy political influence of this magnitude? Beyond the fact that you’re paying a higher share of your income in taxes than Warren Buffet is, that’s the real reason to tax the wealthy more.

[1] Most states have state capital gains taxes, but Texas, Florida, and 6 others do not, so let’s assume that the multibillionaires have figured out how to avoid paying state and local capital gains taxes.